Because it is. Disadvantages of Overdraft Protection An excellent idea in theory yes but there are several disadvantages that you need to know.

But Banks Are More Than Happy To Charge 35 For An Overdraft Fee Lolsnaps Funny Quotes Best Funny Pictures Funny

Overdraft protection is as much of a scam as overdraft fees.

. Overdraft protection sounds like a good idea in theory but it makes a lot of money for the banks and has high fees for consumers. Sounds like the perfect addition to your account right. Here is a look at the pros and cons.

While overdraft protection may sound like a good deal it has some downsides too. But you have to pay back the deposited money with interest. Overdraft protection sounds like a good idea.

Think of it as a super short-term loan with an interest rate pushing 1000 or more. You pay a service fee to cover you for the unfortunate time or two that your bank account is temporarily short of funds avoiding costly returned or NSF cheque charges and the embarrassment of having your payment bounce. And because many consumers use their debit cards numerous times a day.

Overdraft programs are a common feature of banks and credit unions and the amount of money bank overdraft fees rake in each year is rapidly increasing. Other than high fees having overdraft protection runs the risk of having your account closed. Many banks offer overdraft protection also known as overdraft privilege and it might sound like a good idea.

But you are actually paying a fee to access your own money. Overdraft protection is a service offered by banks and other financial institutions. Opt out of Overdraft Fee Protection Programs Offered by Banks.

It can be a never-ending cycle of borrowing money but the good news is weve got three ways for you to pay off that overdraft. Typically these programs ensure your payments are covered up to a certain amount even if you overdraw your account. The amount you borrow to cover the overdraft can be repaid gradually over time as long as you make the minimum monthly payment under the terms of the line of credit.

Overdraft Protection helps you rest easier knowing that your purchases are covered for a modest fee of 400 per transfer much lower than a fee for NSF or the inconvenience and embarrassment of a denied transaction. While having overdraft protection might seem like a good idea there are often high fees associated with it. If you run up several overdraft fees and have a negative account balance the bank will eventually close your account.

But in return for the favor the bank charges a fee to your account. They pay for a transaction if you dont have enough money in your account to cover that purchase. And it helps you build wealth.

If this were free or even reasonably priced then you would say thank you and be grateful that your bank takes such good care of you. Unfortunately this is not the case. Say you want to avoid getting socked by a 35 overdraft fee and your bank offers you something called overdraft protection It may.

Overdraft protection sounds like a positive thing but the fees can be steep. You will be required to pay interest on the borrowed amount. Overdraft protection seems like a good idea.

It doesnt mean you wont pay any fees if you opt in to the service. The way overdraft protection works is that instead of returning the check you wrote for insufficient funds your bank pays the check and gives you a negative checking account balance. On the surface overdraft protection sounds like a great idea if youre making a purchase with your debit card and you dont have sufficient funds in the bank your bank will automatically.

These bank overdraft fees then compound and customers are left with a much heftier sum to pay. Banks would allow customers to spend money that they did not have for a small fee called an overdraft fee. But it will ruin your credit score.

There may be heavy fees and interest associated. Transactions may not go through if your linked account has insufficient funds. In 2017 alone consumers paid a whopping 343 billion in bank overdraft fees.

Overdraft protection can apply to different types of financial transactions. But it will ruin your credit score b. An overdraft fee is a fee charged by a bank when a.

What Is Overdraft Protection. With overdraft protection if you dont have enough money in your checking account checks will. Most banks and credit unions offer overdraft protection for your savings and checking accounts.

This happens until the amount is fully paid. Charges can rack up quickly with multiple transactions if you dont know the hefty fees involved. Like any other loan an overdraft line of credit will be subject to a credit limit depending on the institution as well as their assessment of your credit and other factors.

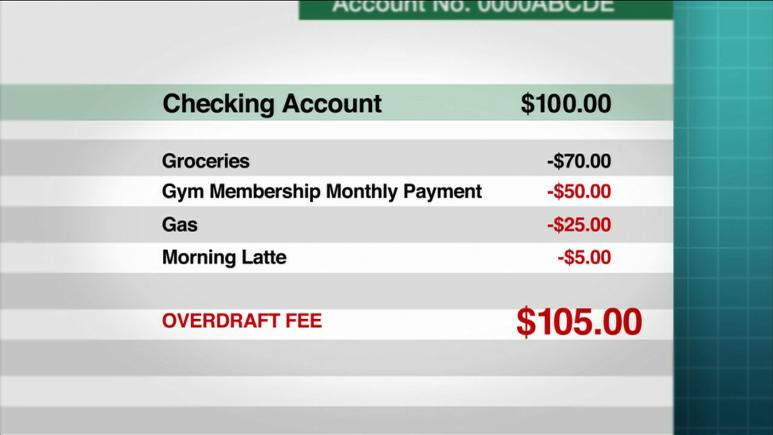

Because it is c. Each time you overdraweven by a few dollarsa hefty fee and potential interest can be charged to your account. To give you an idea of how insane that is if you were to take out a 24 loan and repay it in three days a 34 overdraft fee would represent an APR of 17000.

Fees and interest We stated at the outset that the bank would charge some fees. But you have to pay back the deposited money with interest d. If banks never allowed you to spend money you didnt have aka declining transactions at the register or ATM then they wouldnt need to charge overdraft fees.

Also consumers repaid most overdrafts within three days. Overdraft protection is a guarantee that a check ATM wire transfer or debit card transaction will clear if the account balance falls below zero. Overdraft protection sounds like a good idea.

If youve been living in overdraft protection for quite some time it can start to feel like there is no way to get out of overdraft. Overdraft protection was designed to be a customer friendly service that kept the customer from suffering the momentary embarrassment of a bounced check or declined debit card transaction. And it helps you build wealth.

In 2014 the CFPB found that the majority of debit card overdraft fees are incurred on transactions of 24 or less.

What Is An Overdraft Fee Money Saving Tips Saving Tips Saving Money

Transaction Reordering The Little Known Banking Practice That Could Cost You More Overdraft Fees Rachael Ray Show

Is Overdraft Protection Worthwhile Wealth Management Paying Off Credit Cards Business Expansion

0 Comments